Surprised by the explosive growth in male intimate products? The male sex toy market was stigmatized for decades, but technology is driving unprecedented demand. Smart features and premium materials are reshaping everything.

The global male sex toy market will reach $3.4 billion by 2026, driven by AI-powered devices, app connectivity, VR integration, and premium materials. High-tech masturbators with biometric feedback and customizable experiences represent the fastest-growing segment at 34% annual growth.

I've witnessed this transformation firsthand at VF Pleasure. When I started 15 years ago, male products were basic and hidden. Now, they're the most innovative category in our adult toy factory. Last month, our male adult toys production line couldn't keep up with orders for our smart masturbators. The shift happened fast, and manufacturers who miss this trend will be left behind.

What Technologies Are Revolutionizing Male Intimate Products?

Curious about the tech driving this revolution? Traditional male toys were simple and mechanical. Today's products incorporate artificial intelligence, biometric sensors, and interactive features that create personalized experiences unlike anything we've seen before.

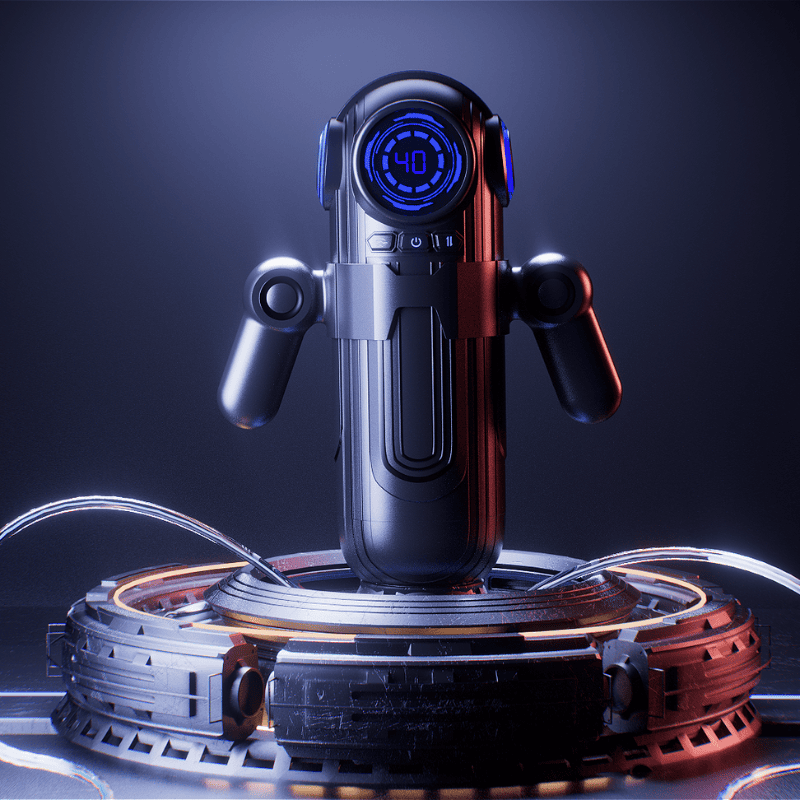

Key technologies include AI learning algorithms, haptic feedback systems, biometric sensors, smartphone app integration, VR compatibility, and teledildonics for remote interaction. These features create adaptive experiences that learn user preferences and respond in real-time.

The technology evolution in our industry reminds me of smartphones ten years ago. At our Shenzhen R&D center, we're developing products that would have been science fiction five years ago. Our latest custom adult toys for male users incorporate machine learning algorithms that adapt to individual preferences over time. The devices learn rhythm patterns, pressure preferences, and timing to create increasingly personalized experiences. Biometric sensors monitor heart rate, skin temperature, and muscle tension to adjust stimulation intensity automatically. Our partnership with tech companies has enabled smartphone integration where users control devices through sophisticated apps with preset programs, custom patterns, and even remote partner control features. VR compatibility is exploding - we're seeing 400% growth in requests for VR-enabled products. The haptic feedback systems we're implementing can synchronize with video content to create immersive experiences. For wholesale adult toys clients, we offer complete technology packages including app development and cloud services. Teledildonics technology enables long-distance couples to share intimate experiences through internet-connected devices. The complexity requires partnerships with software developers, sensor manufacturers, and cloud service providers. When procurement professionals like Felle Reynolds evaluate our adult toy manufacturers capabilities, they're amazed by the technological sophistication. These aren't just toys anymore - they're sophisticated consumer electronics that happen to provide intimate experiences.

| Technology | Current Adoption | 2026 Projection | Key Features | Price Impact |

|---|---|---|---|---|

| AI Learning | 12% | 45% | Personalized patterns | +40% premium |

| App Integration | 28% | 75% | Remote control, data tracking | +25% premium |

| Biometric Sensors | 8% | 35% | Real-time adaptation | +50% premium |

| VR Compatibility | 5% | 30% | Immersive experiences | +60% premium |

| Haptic Feedback | 15% | 55% | Synchronized stimulation | +35% premium |

| Voice Control | 3% | 25% | Hands-free operation | +30% premium |

How Are Changing Demographics Reshaping Market Demand?

Wondering who's driving this unprecedented growth? The traditional male sex toy customer was secretive and price-conscious. Today's buyers are younger, tech-savvy, and willing to pay premium prices for quality and innovation.

Millennials and Gen Z represent 68% of male sex toy purchases, with average spending 3x higher than traditional demographics. These consumers prioritize technology integration, premium materials, and brand transparency over price sensitivity.

The demographic shift has completely changed how we approach product development and marketing at our sex toys factory. Traditional male customers were primarily 35-55, bought basic products, and valued discretion above all. Today's primary customers are 25-40 years old, research extensively online, and share experiences through social media. They expect the same build quality and technological sophistication they find in premium consumer electronics. Our custom sex toys team noticed this shift three years ago when younger customers started requesting features typically found in gaming or fitness products. These buyers are comfortable with subscription services, regular product updates, and premium pricing for superior experiences. They're also driving demand for ethical manufacturing, sustainable materials, and transparent business practices. For our OEM adult toys manufacturer partnerships, we see dramatically different requirements based on target demographics. Younger consumers expect seamless technology integration, while older buyers still prefer simpler, more mechanical products. The spending patterns are remarkable - younger customers invest in premium male vibrator exporter products and regularly upgrade, while older demographics typically make one-time purchases. Social media influence is powerful - products that gain traction on platforms like Reddit or TikTok see massive sales spikes. This demographic also expects excellent customer service, detailed product information, and hassle-free return policies. Understanding these shifts has been crucial for our success in developing products that resonate with modern consumers.

What Role Does Premium Positioning Play in Market Growth?

Surprised by customers paying $200-500 for male intimate products? The race to the bottom in pricing is over. Premium positioning with superior materials, advanced features, and exceptional experiences drives the highest growth and profitability.

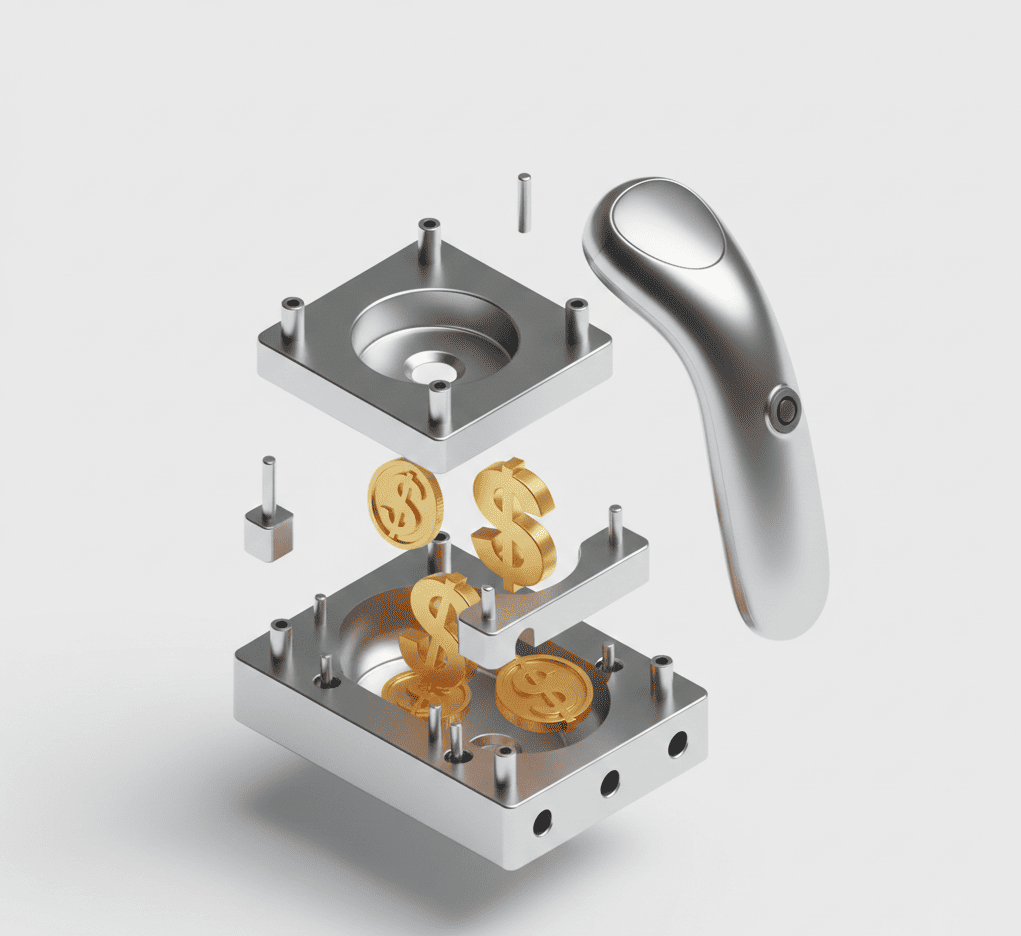

Premium male sex toys ($150+) represent only 25% of units sold but generate 62% of market revenue. High-end products achieve 45-65% gross margins compared to 15-25% for basic products, driving manufacturer focus toward premium segments.

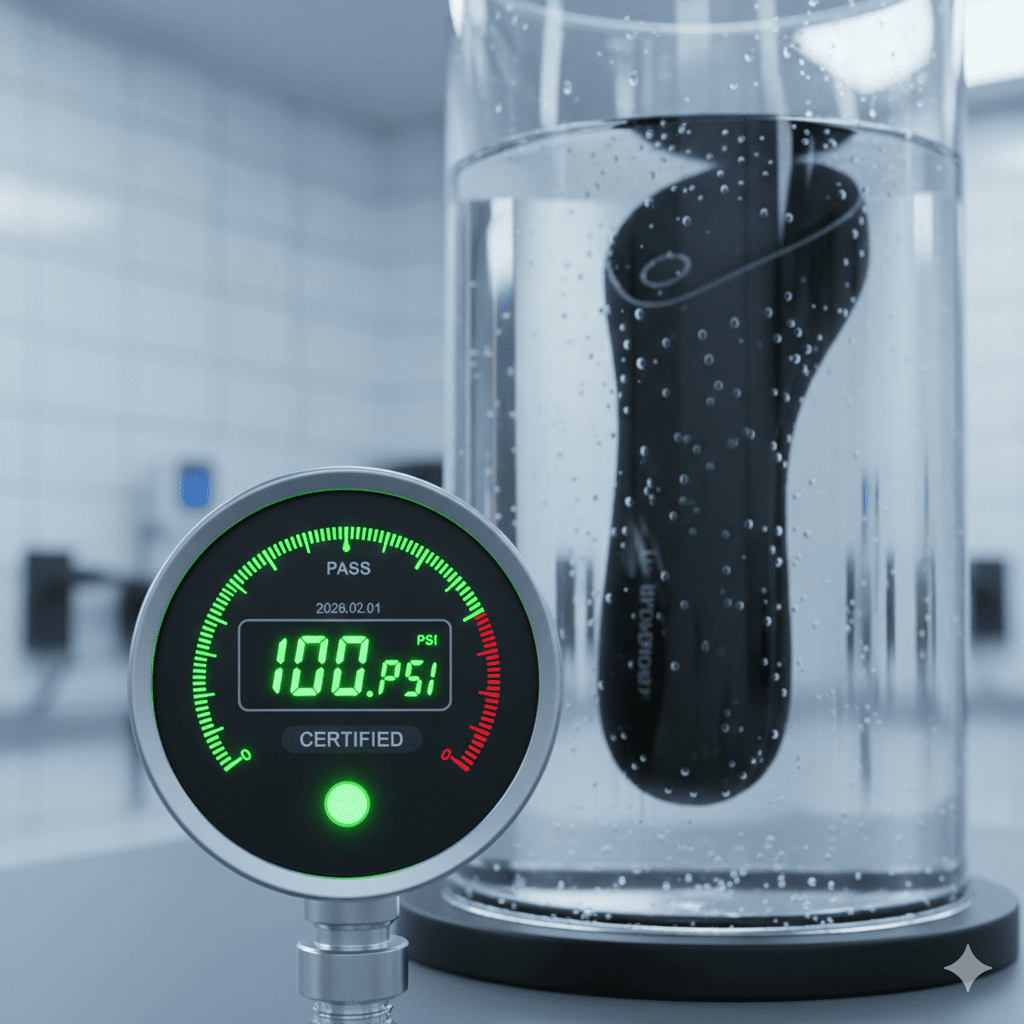

The premium transformation amazed everyone at VF Pleasure. Five years ago, suggesting a $300 male toy would have been laughable. Now, our premium mens vibrator exporter products have six-month waiting lists. The shift started when we realized customers weren't buying toys - they were buying experiences and technology. Our premium line uses aerospace-grade materials, medical-device manufacturing standards, and technologies licensed from tech giants. The build quality rivals luxury electronics with precision engineering, whisper-quiet motors, and lifetime warranties. These products often incorporate multiple patents, custom software development, and exclusive material formulations. For wholesale adult toys clients targeting premium markets, the margins are transformative. Instead of competing on price, we compete on innovation, quality, and user experience. Premium buyers expect exceptional customer service, detailed documentation, and premium packaging that feels like unboxing an Apple product. Our adult toy suppliers network had to completely upgrade capabilities to meet premium standards. The research and development costs are substantial - we invest 18% of revenue in R&D compared to 3-5% for budget manufacturers. But the rewards justify the investment. Premium customers become brand advocates who drive organic growth through recommendations. They're also less price-sensitive during economic downturns and more likely to purchase accessories and replacement parts. For procurement professionals evaluating suppliers, premium positioning requires partners who can deliver consistent quality, ongoing innovation, and comprehensive support services.

How Are Distribution Channels Evolving for Male Products?

Confused by rapidly changing sales channels? Traditional adult stores are declining while e-commerce and mainstream retail expand. Understanding distribution evolution is crucial for reaching modern male customers effectively.

Online direct-to-consumer sales represent 72% of male sex toy purchases, with subscription services growing 156% annually. Mainstream retailers including pharmacies and department stores are expanding adult sections, while traditional adult stores decline by 12% yearly.

The distribution revolution has been the most dramatic change I've witnessed in 15 years. When I started VF Pleasure, adult stores were the primary channel with some mail-order catalogs. Today, most customers never enter physical adult stores. Our bulk sex toys shipments now go primarily to e-commerce fulfillment centers and subscription service warehouses. Amazon changed everything by allowing adult products with strict guidelines about imagery and descriptions. This opened male products to mainstream audiences who would never visit adult stores. Direct-to-consumer brands have exploded because they can control messaging, build communities, and offer superior customer experiences. Our private label sex toys clients often launch exclusively online with subscription models that generate predictable recurring revenue. CVS, Walgreens, and Target now carry male wellness products in health and beauty sections, normalizing these purchases. The key difference is positioning - they're marketed as wellness and self-care products rather than adult toys. For manufacturers, this requires different packaging, messaging, and compliance standards. Our sex toy wholesale team works with retailers to develop appropriate product presentations for mainstream audiences. Subscription services are brilliant for male products because they solve the awkward repeat purchase problem while building customer lifetime value. International shipping has also expanded dramatically with discrete packaging and reliable delivery systems. When working with clients like Felle, we see them adapting to omnichannel strategies that reach customers wherever they're comfortable buying. The manufacturers who succeed understand that distribution is about meeting customers where they are, not forcing them into uncomfortable purchasing situations.

What Manufacturing Innovations Enable High-Tech Features?

Overwhelmed by the complexity of producing smart intimate products? Creating reliable high-tech male toys requires manufacturing capabilities that didn't exist five years ago. Innovation in production methods enables the features driving market growth.

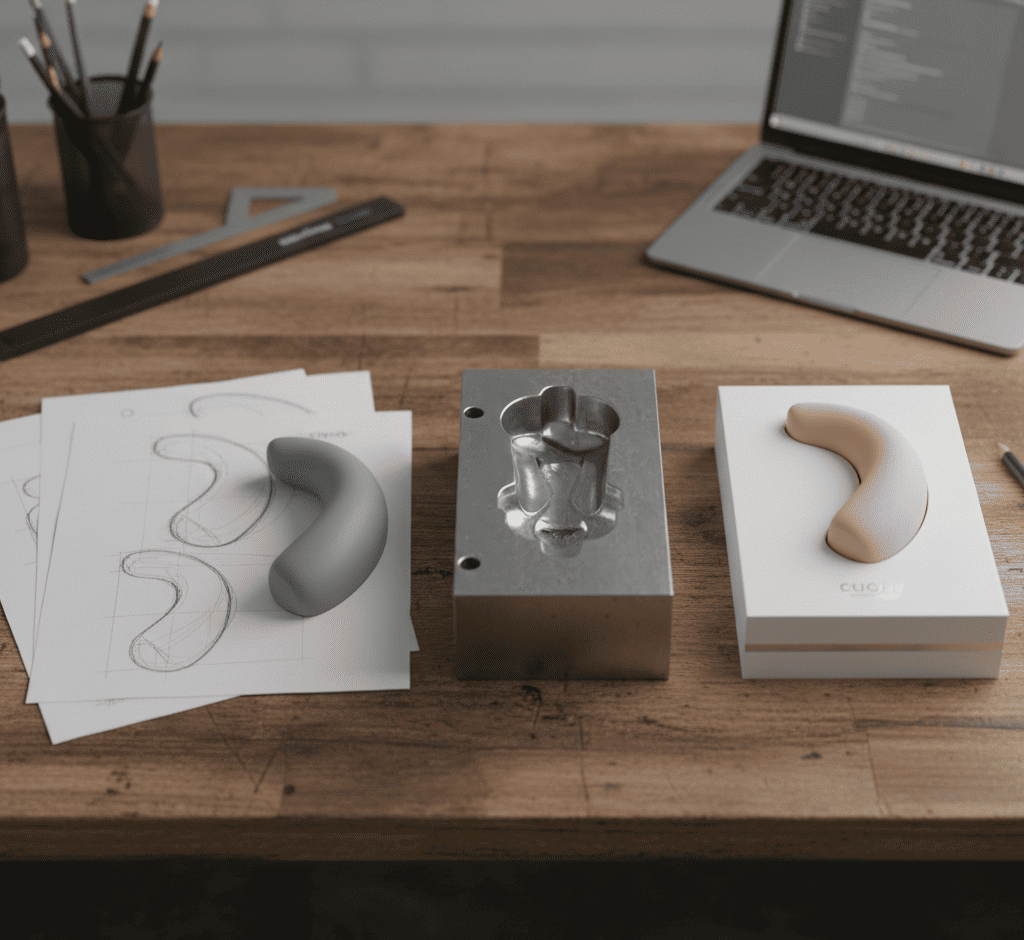

Advanced manufacturing uses flexible silicone overmolding, precision sensor integration, waterproof electronics assembly, and automated quality testing systems. Smart production lines can handle low-volume, high-complexity products with zero-defect quality standards required for premium pricing.

Manufacturing high-tech male products pushed our Dongguan facilities to their limits and beyond. Traditional sex toy manufacturing was relatively simple - mold silicone, assemble basic motors, package and ship. Today's products require capabilities borrowed from smartphone and medical device manufacturing. Our production lines now include clean room environments for electronics assembly, precision molding systems for sensor integration, and automated testing stations that verify every function before packaging. For custom vibrators with multiple sensors and connectivity features, we developed specialized overmolding processes that embed electronics while maintaining waterproof integrity. The challenge is combining soft, flexible silicone with rigid electronic components and sensors that must maintain precise positioning. Our quality control systems use automated testing that simulates months of use in minutes, checking calibration of pressure sensors, responsiveness of haptic feedback, and reliability of wireless connections. Software flashing and calibration happens on the production line with each device receiving unique identifiers for app pairing and customer support. For high-quality guys sex toys exporter products, we maintain pharmaceutical-grade documentation for every component and process step. The investment in advanced manufacturing capabilities was enormous - over $15 million in new equipment and training. But it enables us to produce complex products that would be impossible with traditional methods. Our adult toys custom factory can now handle everything from simple mechanical devices to AI-powered products with cloud connectivity. The key was partnering with electronics manufacturers and investing in cross-training our workforce on both intimate product requirements and high-tech assembly processes.

Conclusion

The male sex toy market transformation is driven by technology adoption, demographic shifts, and premium positioning. Manufacturers must invest in advanced capabilities to capture this high-growth opportunity.

A. SEOPress Title:

B. Meta Description:

C. Target Keywords: male adult toys, male sex toy, mens vibrator exporter, male vibrator exporter, high-quality guys sex toys exporter, custom adult toys, adult