Market data shows conflicting trends, and you're unsure which product category to prioritize for your inventory. Making the wrong choice could mean missing out on significant revenue opportunities.

Clitoral suckers have experienced explosive growth, with sales increasing 300% since 2019, while G-spot vibrators maintain steady 15-20% annual growth. Clitoral suckers now represent approximately 35% of the premium vibrator market, compared to G-spot vibrators at 25%.

I've been tracking these trends closely from our factory floor in Dongguan. As someone who's manufactured both categories for over 15 years, I can tell you the shift has been dramatic. When we first started producing air-pulse technology products in 2018, they were a tiny fraction of our orders. Today, requests for sucking vibrator exporter services make up nearly half of our new client inquiries at VF Pleasure.

Why Are Clitoral Suckers Experiencing Such Explosive Growth?

Wondering what's driving this sudden surge in clitoral sucker popularity? Understanding consumer behavior changes can help you predict future inventory needs and market opportunities.

Clitoral suckers gained popularity due to viral social media exposure, unique sensation technology, and increased sexual education awareness. The "Rose Toy" phenomenon on TikTok alone generated over 200 million views, creating massive consumer demand for air-pulse stimulation technology.

The transformation has been unprecedented in our industry. I remember when the first major brand introduced air-pulse technology1 around 2014. It took years to gain traction. Then social media changed everything. Suddenly, everyone was talking about these products. The discreteness factor plays a huge role too - many clitoral suckers look like everyday objects, making them more approachable for first-time buyers. As a clitoral stimulator exporter2, we've seen orders increase dramatically from retailers targeting younger demographics. The technology itself is fascinating - instead of traditional vibration, these products use air pressure to create suction sensations. This appeals to users who find traditional vibration too intense or numbing. Our R&D team has developed multiple air-pulse patterns specifically for this growing market segment. You can see our latest innovations in suction technology here.

| Factor Driving Growth | Impact on Sales | Consumer Benefit |

|---|---|---|

| Social Media Virality | 300% increase in brand awareness | Normalized conversations about pleasure |

| Unique Sensation Technology | 65% customer retention rate | Novel experience different from traditional vibration |

| Discreet Design | 40% increase in first-time buyers | Reduced purchase anxiety |

| Celebrity Endorsements | 150% boost in premium segment | Mainstream acceptance |

Are G-Spot Vibrators Losing Market Share or Just Stabilizing?

Concerned that G-spot vibrators are becoming obsolete? You want to understand if this category still represents a viable investment for your product line.

G-spot vibrators aren't declining; they're stabilizing in a mature market segment. While growth is slower at 15-20% annually, they maintain consistent demand from experienced users and represent a reliable revenue stream for adult toy manufacturers.

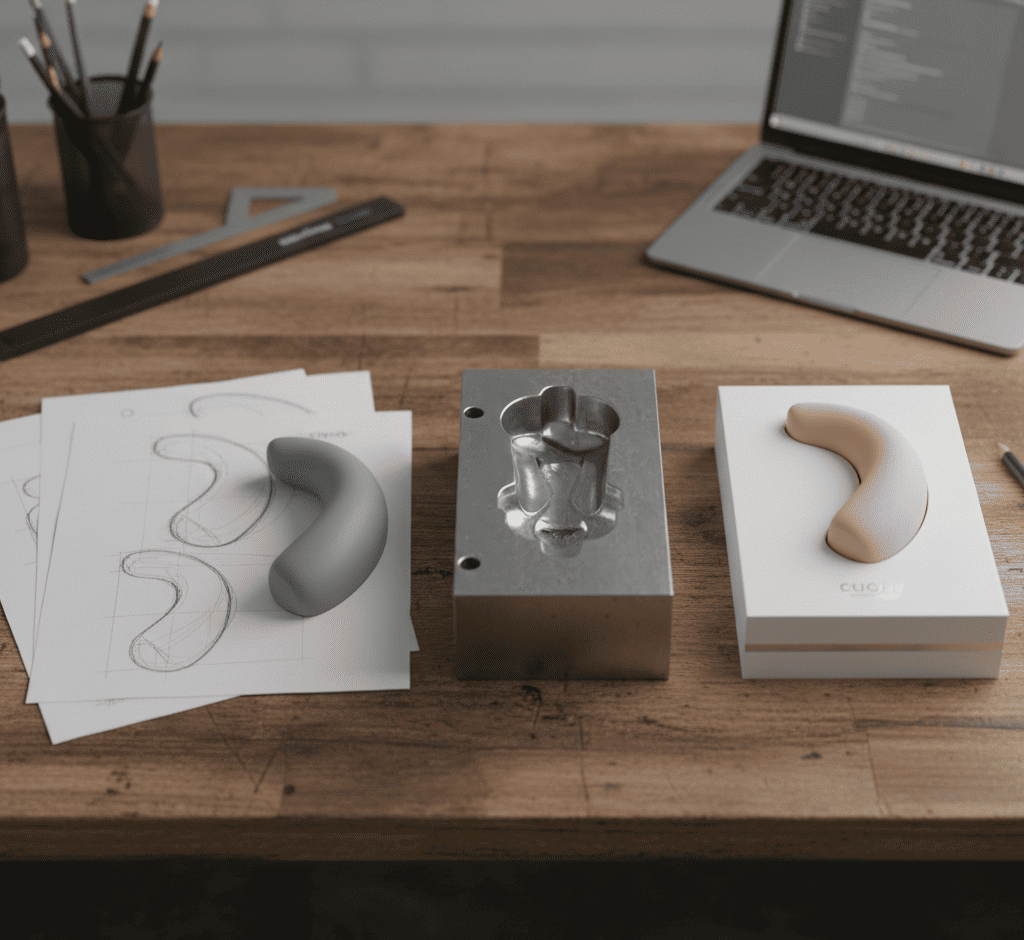

G-spot vibrators represent what I call the "steady foundation" of our business. While clitoral suckers grab headlines, G-spot products continue generating consistent revenue. These products appeal to a more experienced customer base who knows exactly what they want. The market for custom sex toys in this category focuses on refinement rather than revolution - better materials, quieter motors, more ergonomic curves. We've been perfecting our G-spot designs for years, and clients like Felle still place substantial orders for these products because they know their customers rely on them. The key difference is purchase behavior: clitoral suckers often represent impulse or curiosity purchases, while G-spot vibrators are typically researched, intentional buys. This translates to higher customer satisfaction and fewer returns. Many of our clients bundle both categories, using trending clitoral suckers to attract new customers and reliable G-spot products to build long-term loyalty. Our female sex toys category reflects this balanced approach.

Which Category Should You Prioritize for Maximum Profitability?

Torn between chasing the trending market or sticking with proven products? Your inventory decisions directly impact cash flow and customer satisfaction levels.

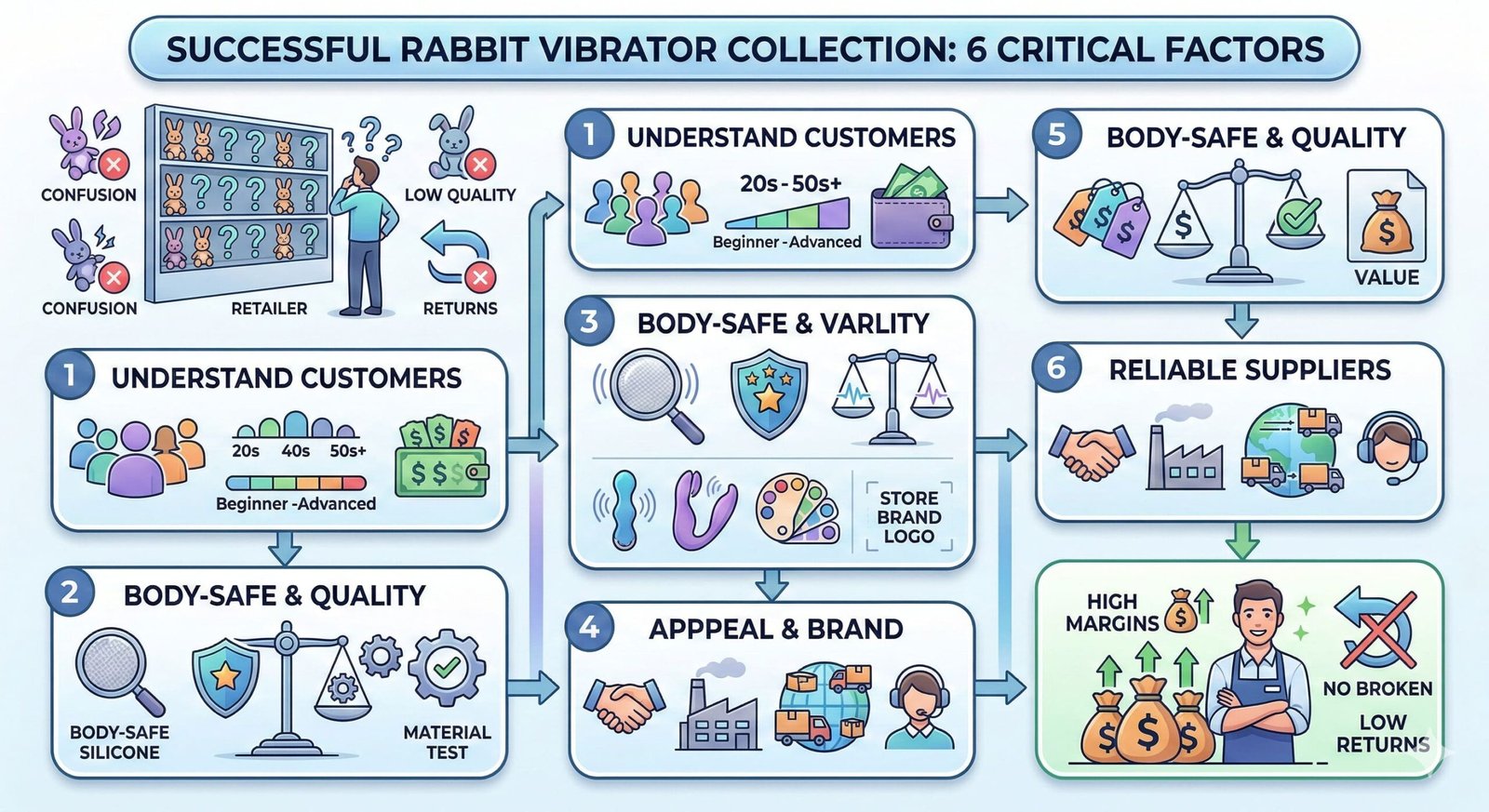

Prioritize a balanced portfolio: 40% clitoral suckers for trend-driven sales, 35% G-spot vibrators for stability, and 25% other categories for diversification. This approach maximizes both immediate profits from trending products and long-term revenue from established categories.

After analyzing data from hundreds of clients, I've found this portfolio balance works best for most retailers. The 40% allocation to clitoral suckers captures the current trend momentum while the 35% G-spot allocation provides stability during market fluctuations. The remaining 25% allows for experimentation with couples toys or male adult toys based on your specific market. Remember, trends can shift quickly in our industry. Having a diversified inventory protects against sudden changes in consumer preferences. As your oem adult toys manufacturer3, we help clients navigate these decisions by providing market data from our global customer base. We track which products perform best in different regions and demographics, allowing you to make informed decisions rather than just following trends. Some clients focus heavily on one category initially, then gradually expand as they understand their customer base better. The key is starting with quality products that represent good value - whether that's an innovative suction vibrator exporter product or a perfectly crafted traditional design.

| Portfolio Strategy | Clitoral Suckers | G-Spot Vibrators | Other Categories | Best For |

|---|---|---|---|---|

| Trend-Focused | 60% | 20% | 20% | New retailers, younger demographics |

| Balanced Growth | 40% | 35% | 25% | Established retailers, mixed demographics |

| Stability-First | 25% | 50% | 25% | Conservative retailers, mature markets |

| Innovation-Led | 35% | 25% | 40% | Premium retailers, early adopters |

Conclusion

Clitoral suckers dominate current growth trends, but G-spot vibrators provide essential market stability. Smart retailers balance both categories to maximize profits while minimizing risk in this dynamic market.

-

Discover the innovative air-pulse technology that is revolutionizing pleasure products and attracting new users. ↩

-

Explore this link to understand the role of exporters in the growing market for clitoral stimulators. ↩

-

Learn how an OEM adult toys manufacturer can help you optimize your product offerings and stay ahead in the market. ↩